Find Funding Faster

Stop wasting months fundraising. We build institutional-grade pitch decks, professional financial models, and focused investor targeting strategies, so you

close faster with better terms.

We are experts at defining, designing, and delivering the best capital sophisticated with ‘early stage’ for sophisticated and emerging businesses.

Story

Investment narrative that converts. Proven frameworks to distill your business model, traction, and vision into a compelling pitch that resonates with investors

Strategy

Fundraising strategy backed by institutional research. Investor mapping, valuation benchmarking, and sector-specific deal intelligence to position your round for success

Systems

Deal execution infrastructure - financial models, data rooms, CRM pipelines, and outreach automation to manage your raise efficiently and close faster

Working With The World’s

Fastest Growing Companies

We work to accelerate ventures across a range of industries including biotech, deeptech, medtech, fintech, proptech, blockchain and more!

180+

5 Years

22

Serving a global client base with a diverse range of founders and founding teams from over 22 countries

98% Rating

A satisfaction rating independently verified via 3rd party platforms with fifty plus five star reviews

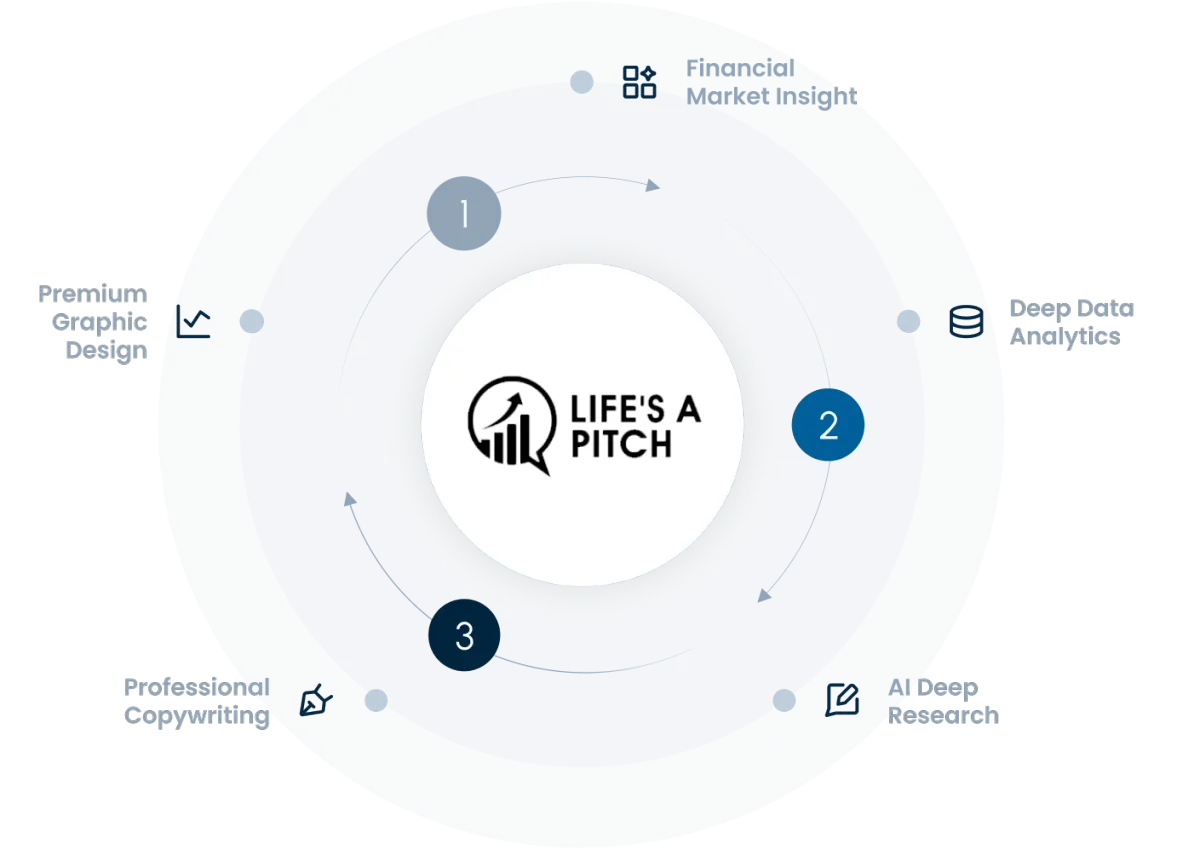

Investment Banking Expertise, Early-Stage Focus

We combine institutional capital markets experience (UBS, NAB, CBA) with deep early-stage tech expertise to delivering pitch decks, financial models, and investor strategies that professional investors expect

Your Fundraising Infrastructure:

Raise Capital With Confidence

1. Pitch Decks

We build institutional-grade pitch decks that convert investors and close rounds

We transform complex business models into compelling investment narratives - distilling your vision, traction, and market opportunity into pitch materials that resonate with professional investors and secure commitments.

✓ Seed to Series B decks

✓ Investment teasers

✓ Information memorandums

✓ Investor roadshow materials

✓ Pitch scripting

✓ Pitch coaching / training

2. Financial Models

Investment-grade financial models that validate your business case and secure investor confidence

We create transparent, defensible models that showcase your unit economics, growth trajectory, and capital efficiency built to withstand investor scrutiny and accelerate due diligence.

✓ Revenue & growth projection models

✓ Unit economics dashboards

✓ Scenario & sensitivity analysis

✓ Cap table modeling

✓ Use of funds & runway analysis

3. Fundraising Infrastructure

Get the systems, investor research, insights and tools you need to launch your raise and manage investor conversations with confidence

From first outreach to final terms, fundraising demands precision execution. We provide the templates, trackers, and infrastructure you need to source and manage investor relationships, streamline due diligence, and maintain momentum throughout your raise.

✓ Investor target lists / database building

✓ AI-assisted investor outreach

✓ Converting outreach emails

✓ Automated CRM & pipeline tracking systems

✓ Virtual data room with smart organization

✓ Smart meeting prep & investor follow-up tools

Your Capital Raise Growth Our Impact

Our partners love the work we do, and we take great pride in the results we deliver. Check out these testimonials from some of our satisfied clients for a deeper understanding of our results and process